When it comes to banking, consumers today move fluidly between apps, websites, branches, and call centers depending on the moment and the stakes. Convenience matters, but so does confidence, especially when finances feel uncertain or complex.

Drawing on research conducted with Kantar’s Accelerated Answers, this article looks at how U.S. consumers are banking today, how open they are to digital tools, and what these evolving behaviors signal for banks and financial brands.

Simplicity and digital access lead the way

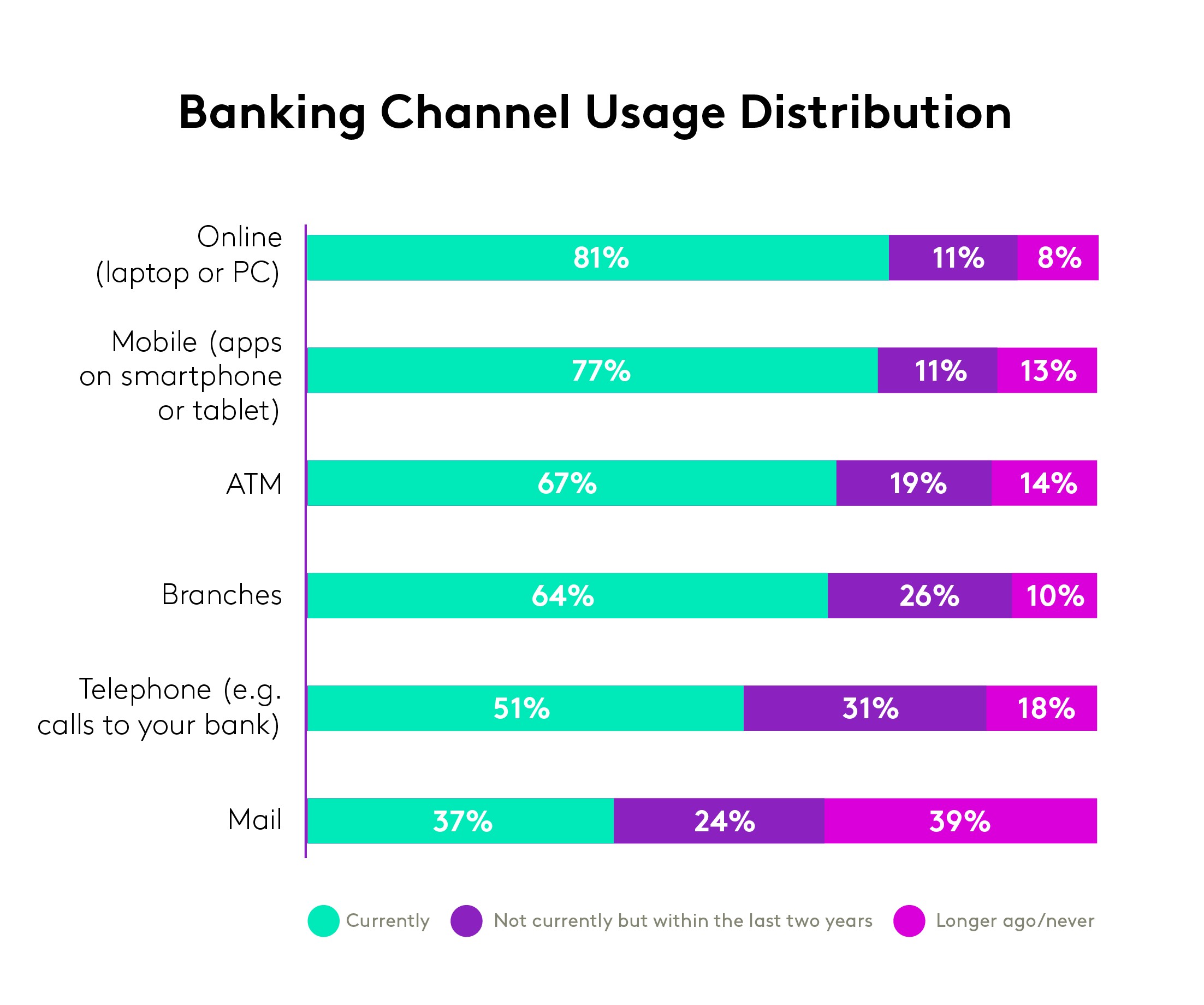

Most Americans prefer to keep their banking streamlined, with 49% using a single bank and another 32% managing finances across just two institutions. This preference for simplicity is echoed in how consumers interact with their banks: online banking via laptop or PC (81%) and mobile apps (77%) are the top channels, but ATMs (67%) and physical branches (64%) still play a significant role. The data underscores a hybrid approach—digital-first, but not digital-only.

Generational shifts

Banking preferences vary sharply by generation. Millennials are the most enthusiastic adopters of mobile apps (87%) and ATMs (74%), while Boomers and the Silent Generation continue to value in-person branch visits (71% and 83%, respectively) and even mail (21% and 50%). Gen Z, meanwhile, blends mobile (79%) with a surprising reliance on telephone banking (68%), reflecting a desire for both convenience and personal connection.

Why consumers choose their banks

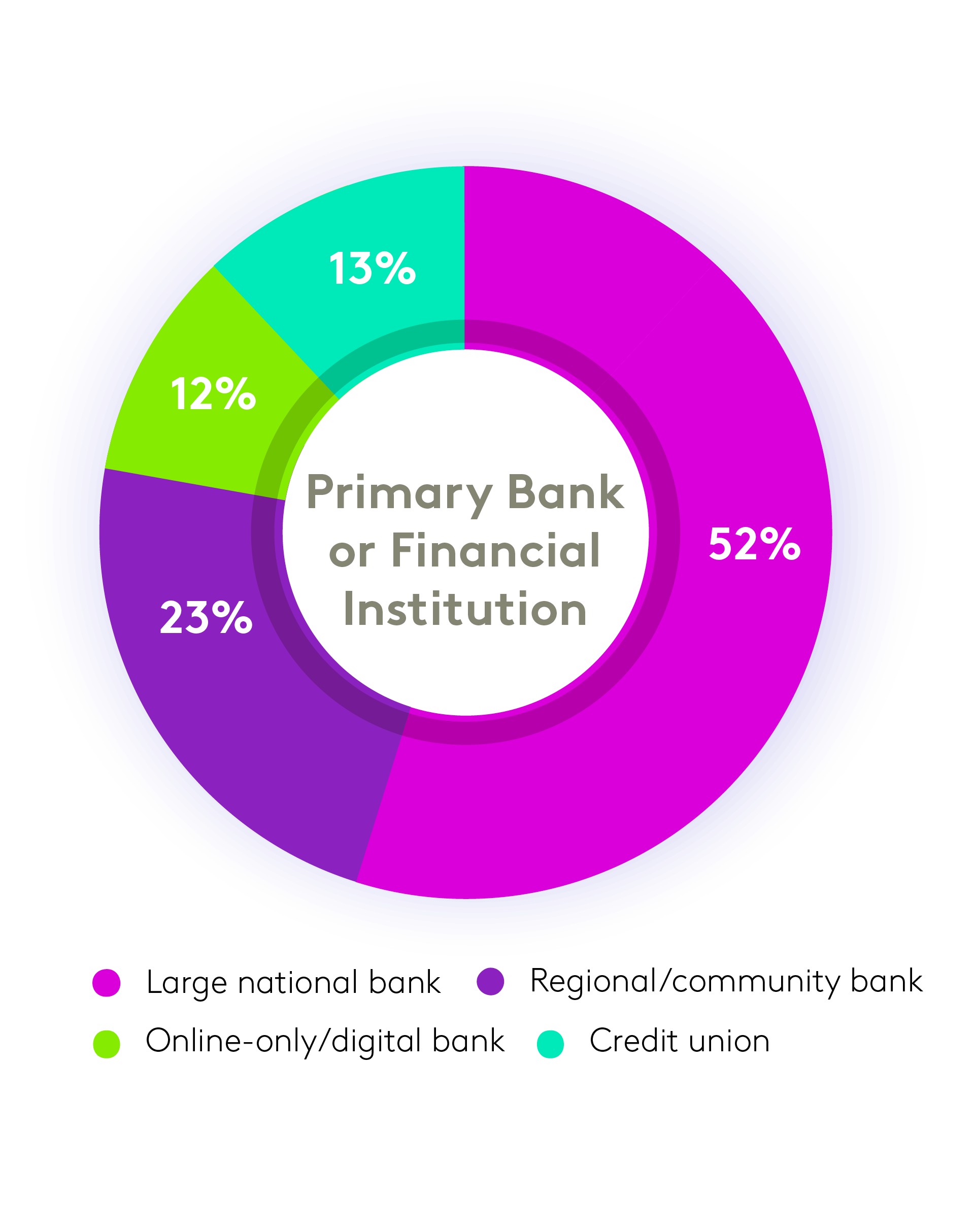

A little over half of U.S. consumers bank with large national institutions, drawn by extensive branch networks, trusted brands, ATM access, and perceived security. Regional and community banks win loyalty through branch convenience and strong customer relationships, while online-only banks attract those seeking superior digital tools and user experience—especially among Gen X. Credit unions stand out for lower fees and better interest rates, appealing to value-driven customers.

Change is the new constant

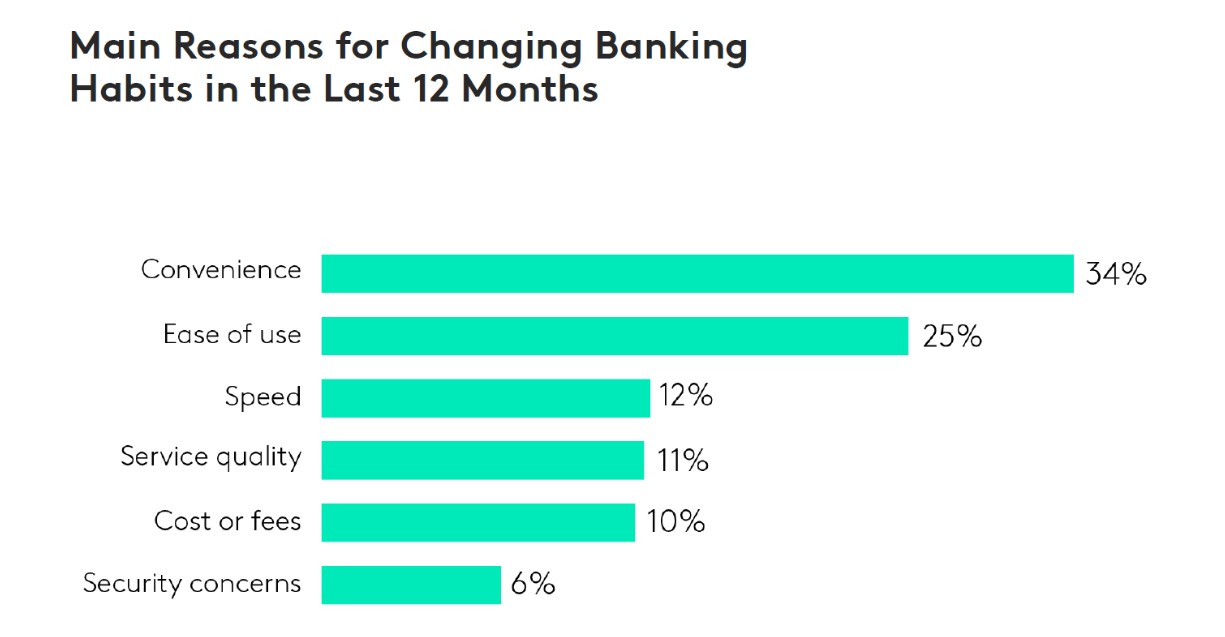

Change is sweeping through the sector: 68% of consumers report altering how they bank in the past year. The top motivators? Convenience (34%), ease of use (25%), and speed (12%) lead the list, far outpacing concerns about service quality, fees, or security. This shift highlights a consumer base that prizes efficiency and seamless experiences, but still expects robust support from their financial institutions.

Conclusion

U.S. banking behavior is in flux, balancing digital innovation with the enduring appeal of trusted brands and personal service. For financial institutions, the message is clear: success lies in delivering convenience and flexibility, while maintaining the human touch that builds lasting trust.

Get more answers

For more findings from this study, access the full report How U.S. Consumers are Managing Finances and get actionable insights to help financial services brands adapt to the needs of today.

About the Research

This research was conducted online via Accelerated Answers, Kantar’s agile survey platform for custom research, among 1,000 U.S. respondents sourced from Kantar’s Premium Panels. All interviews were conducted as online self-completion between 14 - 20 October 2025 and includes consumers ages 18–84 who hold an account with a bank or financial institution, balanced to be nationally representative by age, gender, and region.