Sports is a universal language which has huge global appeal, and the potential to create powerful engagement. A study from Kantar’s Entertainment on Demand has provided a picture of how viewers around the world choose to watch sports across both Pay TV and Video on Demand (VoD). It reveals a rapidly evolving landscape, within which fans are shifting to streaming, and preferences are always changing.

Live sport drives VoD subscriptions

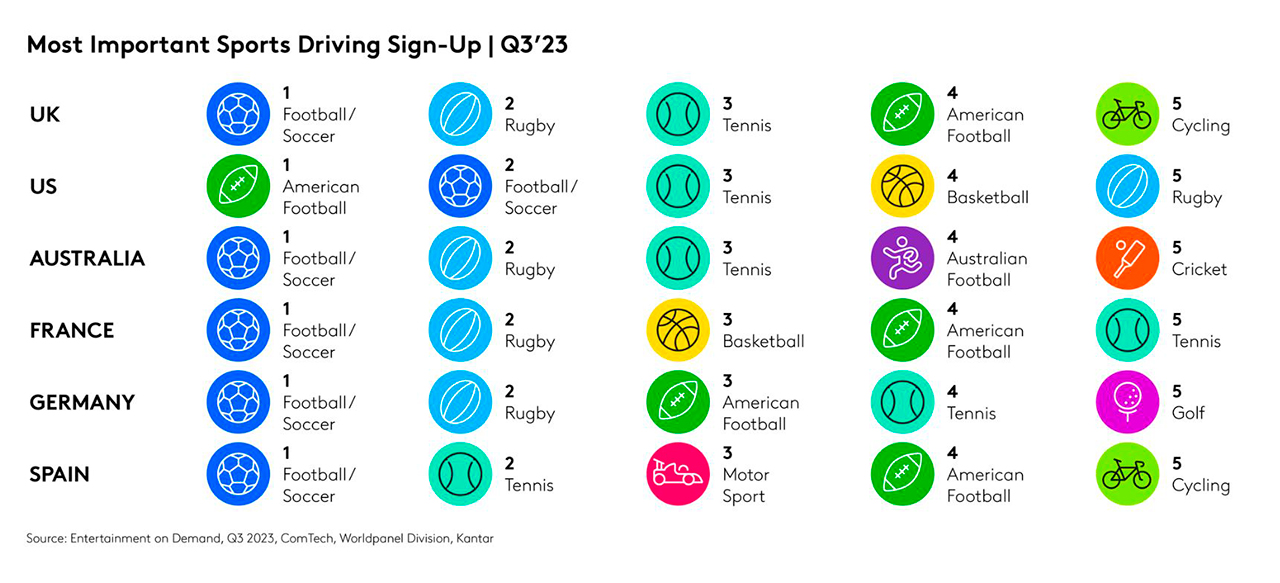

One in five new streaming subscribers are motivated to sign up to see the sports they love. And they like variety. In the US, for example, American football has the biggest influence on the decision to subscribe, but the same household might also watch soccer, tennis, basketball, and even rugby.

Consumers are also interested in sports content that stretches beyond live action, with major growth in documentaries and dramas which help ensure subscribers feel they’re getting value all year round. Bringing behind-the-scenes stories to life builds a wider audience for live sports and strengthens engagement with existing fans. Netflix’s Formula One documentary Drive to Survive, for example, has attracted F1 fans to the service while growing the sport with millions of new viewers globally.

Whatever the platform, if the viewing experience isn’t satisfactory the subscriber will disengage with all the content they receive, which is likely to lead to cancellation. Acquiring the right content simply isn’t enough to secure long-term loyalty.

Delivering value is also important. Nearly one in three households that have a video streaming subscription acquired it as part of a bundle deal or promotion that has ‘something for everyone’.

Understanding pain points is vital

A huge 95% of sports fans in the US stream VoD, while Cable TV (Pay TV) penetration has dropped 8% in two years. In this highly saturated market, streamers must work to understand what does and doesn’t drive satisfaction. It's the same story in Europe, where sports rights are becoming more fragmented. Kantar’s data shows that access to a variety of sports is the top driver of satisfaction in both the US and Europe, while the biggest pain point is the quality of commentators and pundits.

Unlocking new subscribers in Europe

Unlike in the US, there is plenty of headroom for growth in Europe. Of the 22 million households that identify themselves as sports fans, six million don’t currently subscribe to any VoD service.

As a consequence of fragmentation, European fans spend a lot of money on watching sports on VoD and/or Pay TV, with the average bill standing at 88 Euros (£76) per month. This is an investment they are willing to undertake, which makes them a valuable audience to target.

To gain competitive advantage, sports service providers must track and adapt to changing patterns of consumer behavior. This requires a deep understanding of attitudes, preferences, and consumption habits.

To learn more, download the full report Game changer: The evolution of live sports viewing in the US and Europe.

Get in touch with Worldpanel’s Entertainment on Demand team for more insights into the VoD market, the changing Pay TV dynamic, and the challenge of engaging sports fans.