Kantar’s Worldpanel latest Entertainment on Demand (EoD) data and analysis on the global video streaming landscape reveals that sports viewership surged in Q3 2024 thanks to events including the Olympics encouraging more diverse audiences. This growth highlights the increasing importance of live sports for streaming platforms but also the need for investment in high-quality delivery and interactive features to compete with traditional broadcasters.

Kantar’s EoD study uncovers the following behaviors between July and September 2024:

- Half of households watched sports, up from 44% in Q2. Some 56% of new viewers were female and 48% were aged 55+.

- Ad-supported streaming saw significant growth, with AVoD subscriptions (ad-supported video on demand) increasing by 8% quarter-on-quarter and FAST users (free ad-supported streaming TV) growing by 2%.

- Among new users, 39% opted for SVoD (subscription video on demand), while AVoD claimed 29%, FAST 24%, and vMVPD (virtual multichannel video programming distributor) services 8%.

- HBO’s House of the Dragon was the most enjoyed show, followed by The Boys on Prime Video and Bridgerton on Netflix.

- Apple TV+ and discovery+ were the fastest growing major multi-market VoD streamers year-on-year, with the Olympics playing a big role in discovery+ success in 2024.

- After a soft first quarter, Prime Video rebounded to achieve the highest share of paid VoD subscriptions in both Q2 and Q3 – positive signs as it heads into holiday season.

- 26% of Apple TV+ users that have at least one other subscription ranked it as their most important service, up from 20% this time last year.

Andrew Skerratt, Global Insights Director at Kantar, comments: "While the buzz around ad-supported tiers is undeniable, there’s an emerging battleground between content and acquisition strategies. Hit shows like House of the Dragon prove content is still king, but clever bundling and free trials, as well as enhanced features like those in live sports streaming present big opportunities. Services that understand local preferences and provide a unique offer are also making big gains."

Live sports are reshaping VoD

Sports viewership surged with half of all households tuning in – up from 44% in Q2. Despite much of this still coming via paid TV and linear channels, the gradual shift to streaming presents significant challenges for traditional sports broadcasters who must adapt quickly as the line between live and on-demand continues to blur. Sports viewership was highest in France (57%) and lowest in GB (41%). Notably, of those who didn’t watch sports in Q2 but did this summer, 56% were women and 48% were over 55. Meanwhile, the Olympics accounted for one in four new Discovery+ subscribers in Q3, making it one of the fastest growing services in 2024. Sports viewers’ engagement is also high across related categories, with just over 20% regularly listening to podcasts to enrich their sports experience.

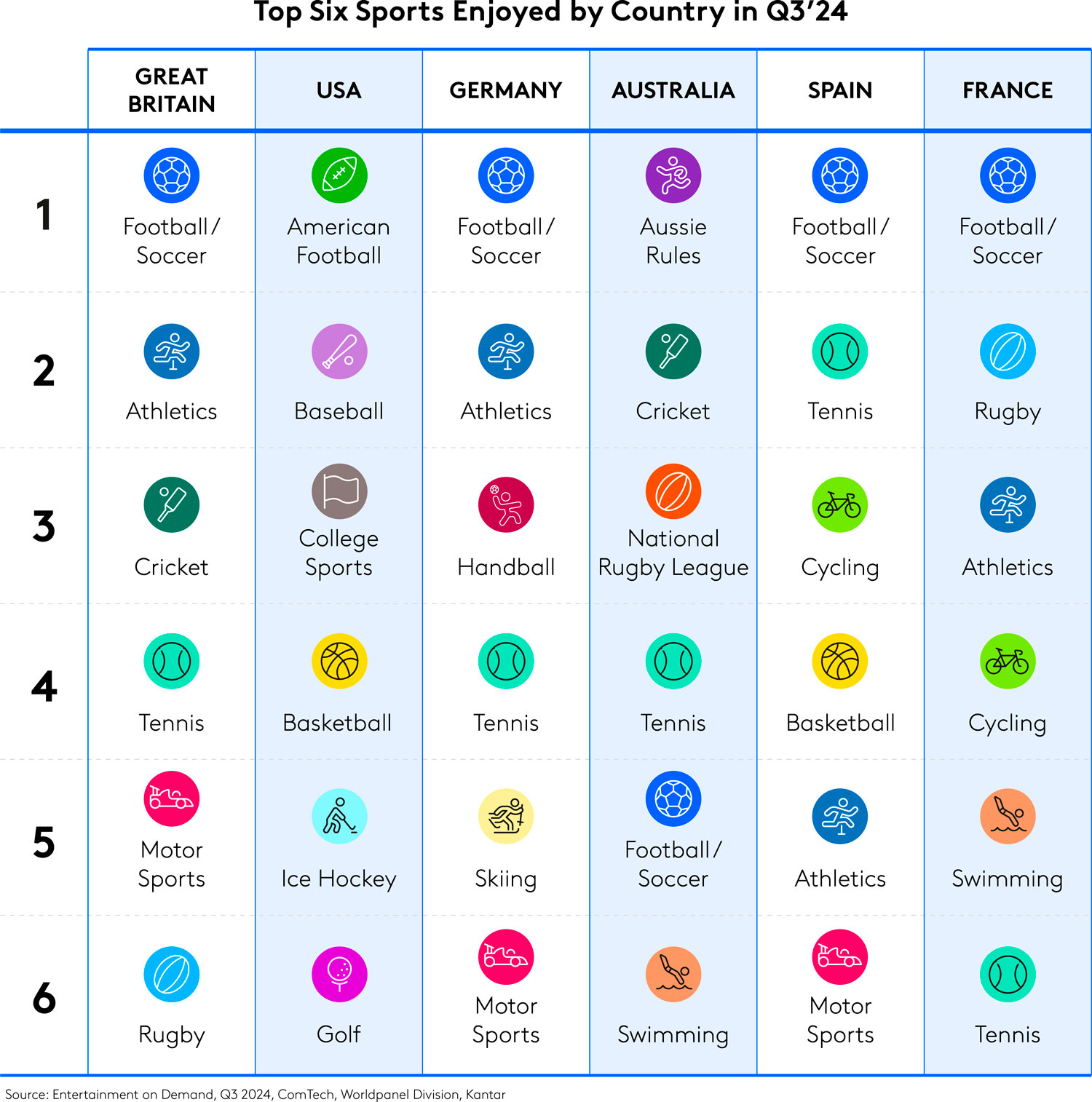

Top sports enjoyed by sports viewers, Q3 2024

Andrew Skerratt continues: “Live sport is playing an increasingly important role in user retention as it brings in a substantial live viewership that’s rare for other on-demand content. And everyone's a winner. Regional sports are reaching international audiences they never used to. Viewers are excited by advanced technology like interactive statistics and immersive interfaces. Streamers are now using this to cash in on new subscribers – sports fans are a highly engaged, valuable audience who exhibit stronger satisfaction and loyalty to their regular TV services. However, succeeding in sports on demand requires more than content rights. Leading services must invest in high-quality delivery, top-tier commentators and interactive features to build a dedicated sports audience.”

House of The Dragon is the powerhouse of growth

The latest instalment of HBO's high-stakes fantasy drama House of the Dragon emerged as the most enjoyed title of Q3 2024 by a considerable margin. The series, along with the streaming platforms hosting it globally, delivered a strong Q3 performance, emphasizing the show's significant impact on subscriber growth and engagement worldwide. This effect was particularly notable in France, where House of the Dragon played a major role in the successful launch of Max, which became the second most-adopted streaming service in Q3, just behind Prime Video.

Local content is winning subscribers

Over the past two years, Germany has led the way in VoD market growth, with penetration increasing by 8% points, faster than any other global market. Notably, local services are driving this trend, with substantial growth in Q3 a continuation of a strong upward trend over the past year. Platforms including Joyn, WOW, RTL+, Magenta TV, and Waipu have seen strong growth, largely driven by highly localized content, highlighting the vital role of tailored content in attracting subscribers, especially as households fine-tune their entertainment portfolios to maximize value.

Disney+ & Apple TV+ reveal the future of subscriber acquisition

Advertisements across all forms remain the top method for attracting subscribers, but bundles and free trials are growing and now account for 24% of all subscriptions globally. These often come from partnerships with pay TV or internet providers and through streaming services, hardware, banking, or retail purchases.

Disney+ capitalized on high-profile promotions in GB, including a £1.99-for-three-months deal and partnerships with well-known brands like Lloyds Bank and Tesco to broaden its reach. Apple TV+ provided an example of ecosystem integration, offering a three-month free trial with new Apple hardware purchases. However, this can lead to elevated churn rates: households that cancelled Apple TV+ in the past three months reported an average service importance ranking of 3.0 for Apple TV+ pre-cancellation. To secure its place as a must-have service, Apple TV+ must focus on deeper engagement strategies.

Access and embed the interactive data visualization for more information and reach out to our experts.

Note: Unless stated otherwise, all data refers to the US, Australia, GB, Germany, Spain, and France.